A new coffee landscape is brewing as old habits evaporate.

Walking home from work on a chilly Friday evening I was stopped by a striking, if not uncommon sight - hidden behind the steamy windows of the local Caffè Nero was a buzzing, almost full coffee shop. Mostly younger men and women in groups, plus a few late workers and a smattering of students cramming on laptops.

Whilst there’s nothing unusual about people meeting friends for a drink to kick-off the weekend, what struck me was that this coffee shop was busier at 6pm on a Friday than most of the pubs and bars along the same street. Despite all the noise about the trend towards younger people drinking less alcohol, it still seemed odd that so many people were choosing coffee over a pint at this time.

A few days, a dozen or so Americanos and countless data points later, I found that younger people are developing a very different relationship with coffee, with potentially huge implications for both FMCG and FTG brands.

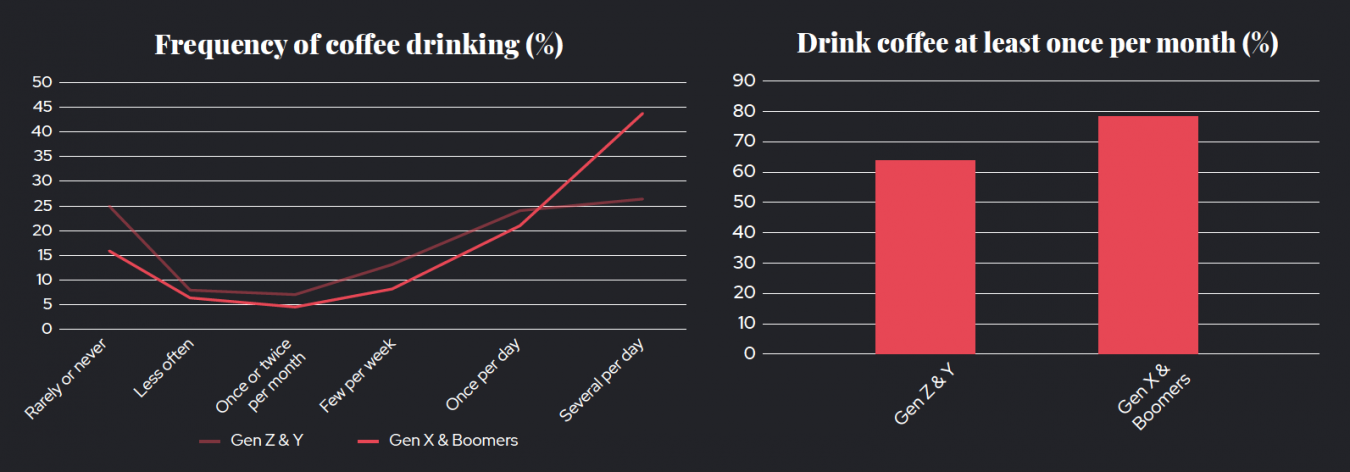

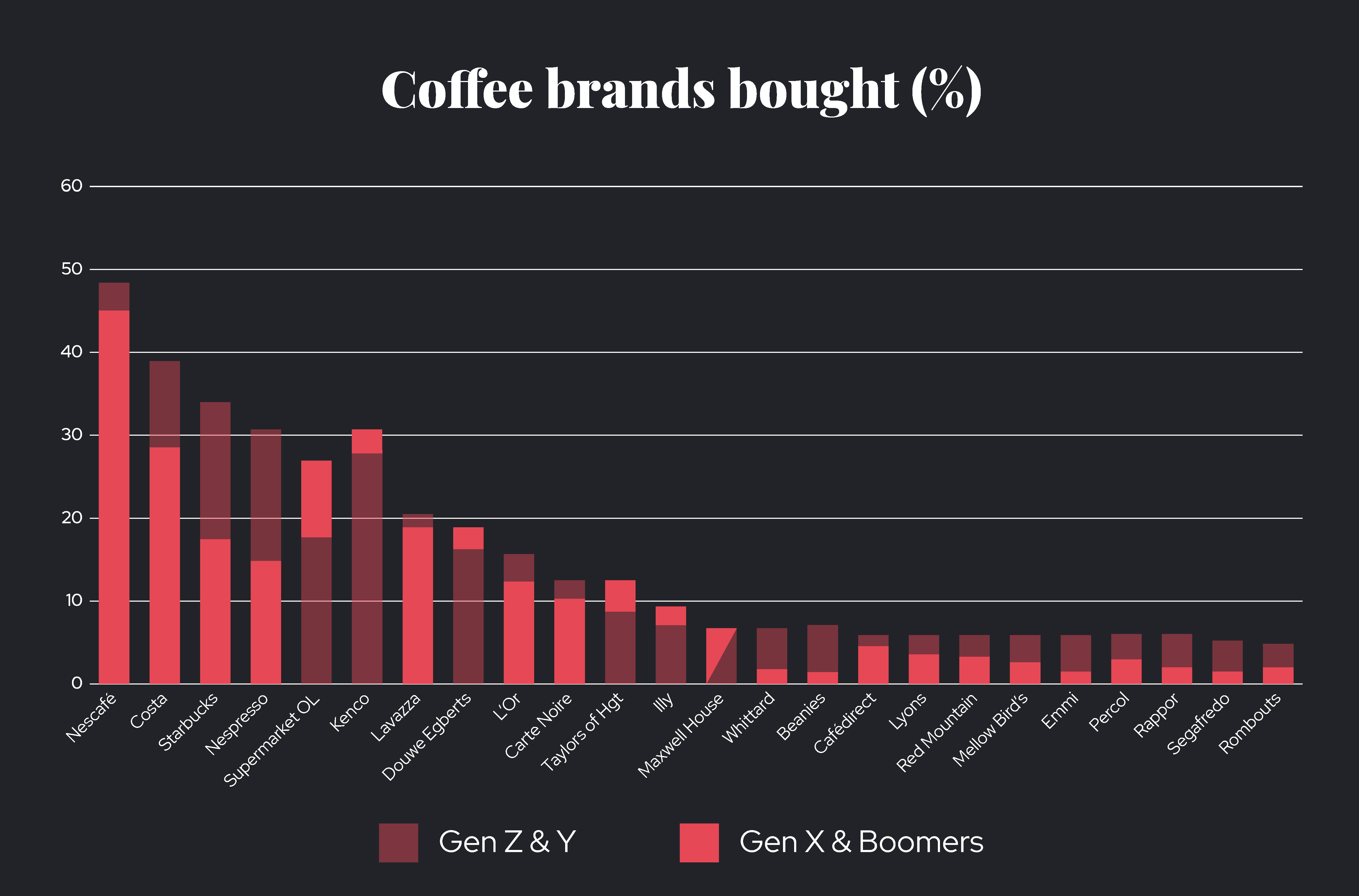

Most significantly, we found that young people are drinking coffee less often, spread across more brands, types and formats.

In comparing regular coffee drinkers in Gen Z and Y with Gen X and Baby Boomers we found what you might expect of older coffee drinkers who’ve grown up with fewer options, and therefore formed more rigid habits which have made for a reasonably stable market for decades. I know what I like and I like what I know, right?

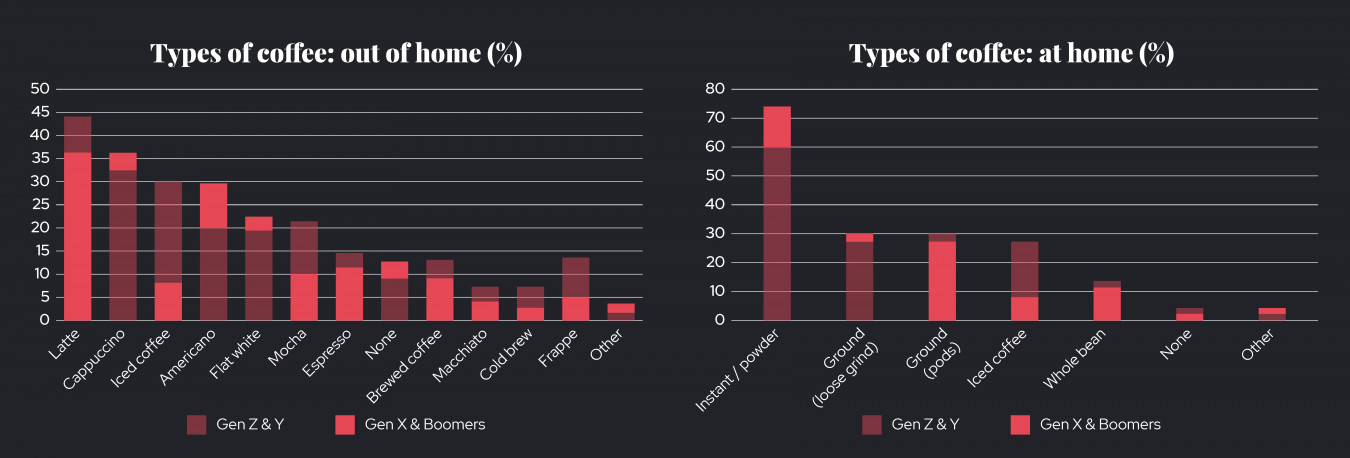

By comparison, the younger group have grown-up in the era of the Macchiato, not the age of Gold Blend. They’re drinking coffee hot and cold, in and out of the home, AM or PM, convenient and arduous, latte with breakfast and flat white after lunch.

Not only did we find that young people are drinking coffee across a wider range of brands, they’re also drinking them across more formats (i.e. pod machines, ground, instant) as well as types; where the older group are more loyal to instant coffee or the Cappuccino, younger coffee drinkers are much more varied in their taste.

For marketers, this unpredictable and changing behaviour presents the obvious challenges and opportunities associated with a market which is becoming increasingly fragmented, none of which good research, accurate diagnosis and solid strategic thinking, plus a couple of extra shots, can’t navigate.

But in this instance, I’m also interested in the role of habits. Marketers can’t overlook the importance of habits in the success of such a high-frequency everyday product, and they can’t ignore the habitual nature of coffee consumption in days gone by.

Whilst behavioural scientists debate the exact amount of time, research from UCL suggests it takes around 10 weeks to form a habit; do the same thing, in the same way, at the same times for just over 2 months and an action becomes second nature.

It’s easy to see then why our older audience enjoy less variety in their coffee, through the deep formation of habit, they are stuck in their ways. In this new era, it’s unrealistic for brands to even imagine the same level of habitual dormancy from their customers. But it is still possible to imagine the formation of new habits within this chaos.

If marketers and brand owners are realistic about what they can achieve and do their homework to understand their audience, through the steam they’ll see the emerging habits, or opportunities to encourage them. The question then is whether they’ll have the confidence to focus on a that single behavioural insight as a point of distinction, rather than aiming to push a single coffee brand, product or format as the answer for all needs and occasions, which couldn’t be further from the reality for the younger coffee drinker.

Want to know more about how your shoppers and consumers are behaving? And how we can help make your brand unforgettable? Get in touch for a chat over a good cup of... tea?